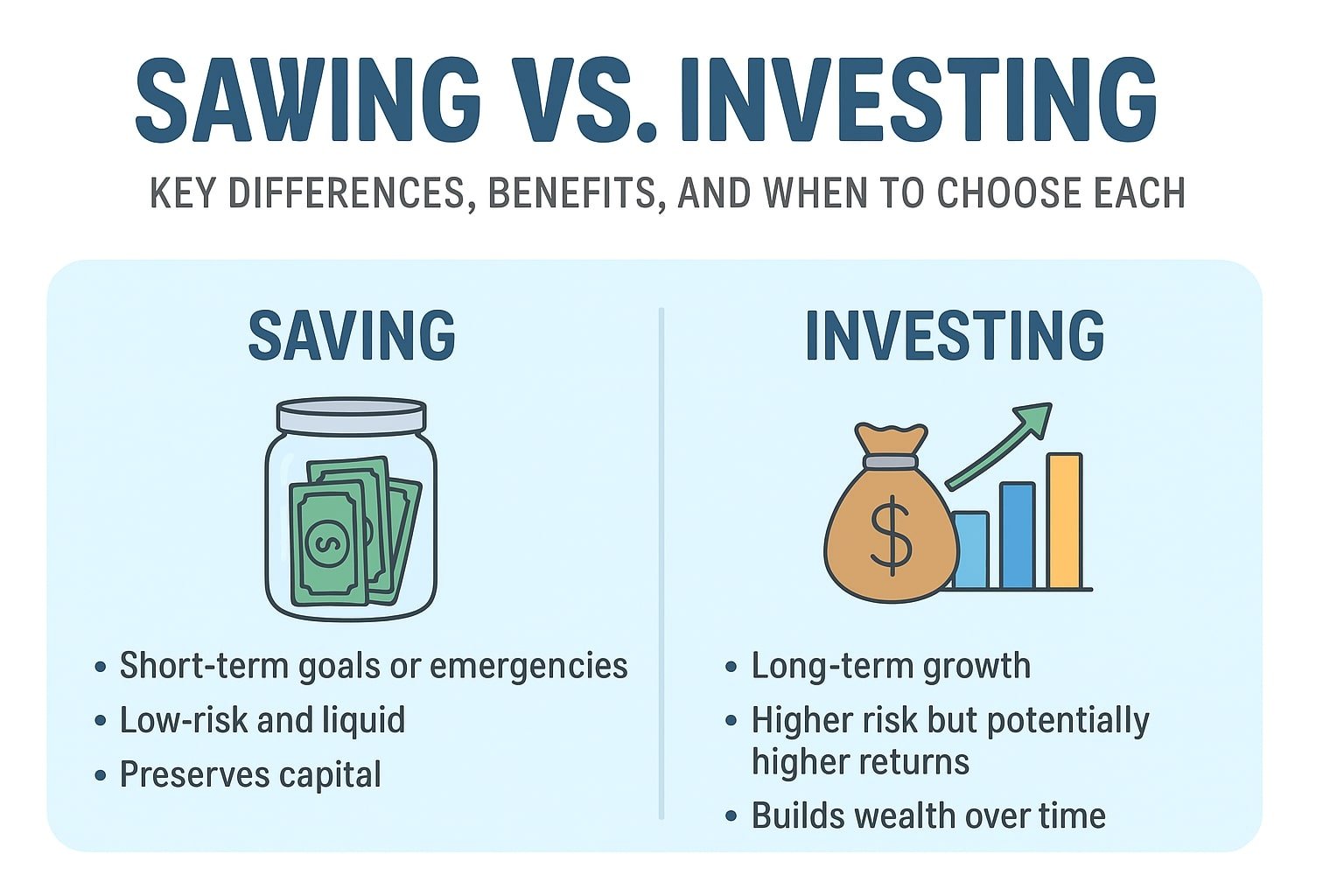

Understanding the difference among saving and investing is one of the most fundamental standards in non-public finance, but many human beings confuse the 2. Each strategies are important for financial stability and wealth-building, but they serve unique functions and convey wonderful stages of chance and potential praise. Gaining knowledge of the difference allows you to make smarter choices about your cash, meet quick-time period and lengthy-time period goals, and construct a cozy monetary destiny. Understanding while to shop and when to make investments can dramatically effect your economic growth and peace of mind.

Understanding the concept of Saving

Saving refers to setting apart money for quick-time period wishes or emergencies. It’s miles normally low-danger and without difficulty reachable, frequently saved in savings bills, money market accounts, or certificate of deposit. The number one goal of saving is capital preservation, making sure that your money is available while wished with out the risk of losing fee.

Savings are important for economic stability. They provide a buffer for surprising expenses which includes clinical payments, car maintenance, or temporary income loss. This “emergency fund” prevents you from counting on excessive-hobby debt while existence throws sudden demanding situations your way. Financial advisors frequently recommend preserving 3 to 6 months’ worth of dwelling charges in a with no trouble available financial savings account.

Even as saving is secure, it typically gives modest returns. Hobby costs on savings debts and other low-danger devices are commonly lower than the potential growth presented via investing. Inflation can also erode the purchasing electricity of your financial savings over the years, making it essential to balance saving with different techniques to grow wealth. Notwithstanding these obstacles, saving forms the muse of accurate financial management, allowing you to cowl instantaneous needs and prepare for future opportunities.

Knowledge the concept of investing

Investing, however, is about setting your cash to work to generate increase over the long time. Investments include stocks, bonds, mutual price range, actual property, and different economic units which have the ability to realize in cost or produce earnings. In contrast to saving, investing includes danger—the cost of your belongings can fluctuate, and there’s a possibility of loss. But, it also provides the possibility for better returns and wealth accumulation over time.

The primary motive of investing is long-term boom. While saving is good for brief-term goals or emergencies, investing is higher applicable for goals inclusive of retirement, shopping for a home, or funding schooling. The longer your funding horizon, the greater you may gain from compounding—in which your returns generate extra earnings, creating exponential boom through the years.

Investing also gives diversification possibilities. By using spreading your money throughout specific asset lessons, industries, and geographical regions, you reduce the impact of person marketplace fluctuations. Diversification is a key principle of hazard control, helping traders attain balanced growth with out depending entirely on one investment type.

Key variations among Saving and investing

The main variations between saving and investing lie in threat, liquidity, and returns. Savings debts and similar contraptions are low-chance and highly liquid, meaning you could get right of entry to your cash fast with out dropping fee. Investments carry higher danger, and the cost of your property can vary, but they provide the potential for extra returns over the years.

Time horizon is any other important thing. Savings are first-rate for quick-time period goals and emergencies, whilst making an investment is good for long-term targets. For example, cash set apart for a holiday in six months should remain in a savings account, whereas budget earmarked for retirement a long time away ought to be invested to maximise growth.

Any other distinction is the position of interest versus increase. Savings accounts earn hobby at a set or variable rate, imparting modest, predictable returns. Investments, through evaluation, develop via marketplace appreciation, dividends, or condominium profits, presenting doubtlessly higher but much less predictable returns. Know-how this distinction allows you to allocate sources efficaciously and gain both quick-term protection and long-term wealth.

Behavioral components additionally vary. Saving calls for area to continually set aside funds, regularly resisting temptation to spend. Making an investment calls for expertise, endurance, and a willingness to tolerate brief-term fluctuations in pursuit of lengthy-time period dreams. Both strategies benefit from cautious planning and knowledgeable selection-making, but they cater to one-of-a-kind financial goals.

Growing a Balanced technique

A successful monetary method normally entails a mixture of saving and making an investment. Savings provide safety and peace of mind, while investments pressure increase and wealth accumulation. Allocating price range correctly between these strategies guarantees that immediate needs are met with out sacrificing future possibilities.

Begin by building an emergency fund via saving. This creates a monetary protection net and reduces reliance on credit score in the course of surprising activities. As soon as this basis is established, begin investing extra finances to obtain lengthy-time period goals. Different investments including shares, etfs, mutual budget, and actual estate can help grow wealth while dealing with chance.

Often reviewing your monetary desires is important. Brief-term targets might also require more emphasis on saving, at the same time as long-time period plans ought to prioritize making an investment. As situations alternate, adjusting the balance between saving and making an investment ensures that your financial approach stays aligned along with your wishes and aspirations.

Education is likewise vital. Understanding the risks and rewards of different investment alternatives, staying knowledgeable about market trends, and constantly comparing your monetary state of affairs permits smarter selection-making. Computerized gear, economic advisors, and academic sources can help novices navigate the making an investment panorama confidently.

Via integrating both saving and investing right into a cohesive plan, you create a economic device that protects you within the present while constructing prosperity for the future. This approach fosters balance, boom, and versatility, enabling you to achieve dreams starting from quick-time period purchases to lengthy-term wealth advent.

Saving and investing serve awesome but complementary purposes in private finance. Saving guarantees safety and liquidity for fast desires and emergencies, while investing lets in your cash to develop over time, building lengthy-time period wealth. Knowledge the differences, handling hazard, and creating a balanced method permits you to maximize economic possibilities and gain your goals effectively. By means of combining disciplined saving with knowledgeable making an investment, you could construct a stable and rich monetary future, regardless of your earnings stage or monetary historical past.

[…] of long-term dreams. Prioritizing budgeting, dealing with fees, maintaining an emergency fund, saving diligently, making an investment strategically, and committing to non-stop gaining knowledge of create a complete framework for monetary success. […]

[…] along with credit cards or non-public loans, reduces financial burdens and frees up finances for financial savings and investments. Avoiding needless debt keeps financial flexibility and forestalls setbacks on the direction to […]

Okay, tk88vina is legit! Been playing for a while now and haven’t had any issues. Reliable and fun, which is all I ask for. What are you waiting for tk88vina