Are you thinking about getting a loan? No matter for what purpose it is, be it a new car, a house, or personal needs, it is very important to know how much you will have to pay each month. To help you in such a scenario, our free online loan calculator assists you in no time with calculating your monthly payments, total interest, and overall loan cost thus making it easier for you to take right financial decisions.

What Is a Loan Calculator?

A loan calculator is an instrument that helps you with your finances as it can provide you with an estimate of the monthly repayments on a loan, considering the following points:

- Loan principal amount

- Interest rate

- Loan period (measured in months or years)

All of these inputs allow you to visualize what different scenarios of loan terms or interest rates will look like in terms of your payments, without having to do any number crunching yourself.

How to Use the Loan Calculator

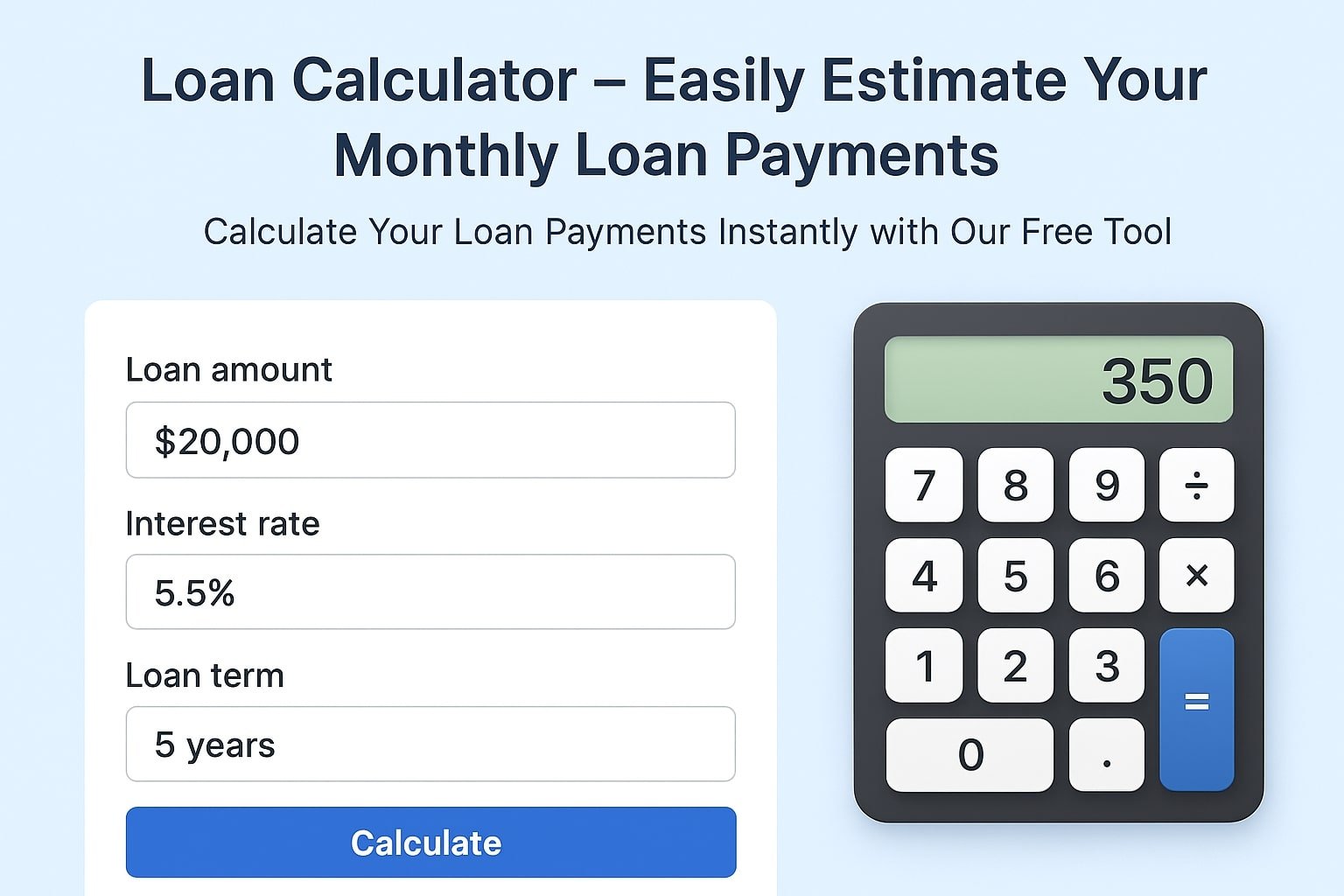

It is very easy to use our loan calculator:

- Provide the loan amount – the sum that you are going to borrow.

- Pick the interest rate – it could be fixed or estimated according to lender’s offers.

- Select the loan duration – in months or years.

- Touch the button “Calculate” – and you will see your monthly payment, total interest paid and total repayment amount.

This will aid in your budget planning and also in your comparison of loan offers.

Why Use a Loan Calculator?

There are several reasons to use a loan calculator before submitting your loan application.

Some of these reasons are:

✅Budget at your convenience – Be sure of what you can spend without taking any risk.

✅Loan offers comparison – Compare interest rates and terms of the different loans in parallel.

Loan calculator helps you to gets rid of unexpected developments by giving a clear view of the total interest amount you will pay over the loan’s duration. You will also be able to choose a loan that suits you best by making well-informed financial decisions.

Types of Loans You Can Calculate

Loan calculator can be used for various types of loans like the following:

🏡 Home loans / mortgages

🚗 Auto loans

💳 Personal loans

🏫 Student loans

💼 Business loans

Regardless of the type, you will have a solid understanding of your total repayment obligations.

Best Loan Terms Tips

When applying the calculator, be mindful of the following tips:

📉 Try for a less interest rate – Even a 1% difference can lead to a great savings.

⏳ Shorter terms = lower interest – But increased monthly payments.

🧾 Review for additional fees – There are lenders who levy extra charges such as processing or early repayment fees.

💳 Raise your credit score – A higher credit score is tantamount to getting better loan offers.

Frequently Asked Questions (FAQs)

❓ Is the loan calculator a free tool?

Indeed, it is completely free, and it can be accessed through the internet anytime.

❓ Is it applicable to all currencies?

It is, and simply input the amount in your home currency. The calculator accepts any currency input.

❓ Is it possible to compute variable interest rate loans?

The regular calculator is based on fixed rates, however, you may alter the rate to imitate changes.

❓ Is this calculator appropriate for mortgages?

Certainly. Just provide the mortgage amount, rate, and term for an accurate estimation.

Plan Your Loan Today

Do not speculate; instead, calculate. Our loan calculator is free to use, and it will help you to know your monthly payments, total interest, and how much your loan will actually cost. Be it a mortgage, car loan, or personal loan you are interested in, this tool offers you the quiet assurance of making well-informed financial decisions.

👉 Go ahead and try the loan calculator right now, and take charge of your finances.

Heard some whispers about r7bet1. Decent selection of games, from what I saw. Nothing blew my mind, but it’s okay. Take a peek at r7bet1.

wgjmgnhvrvokjoendxmyhuxvkmvpvm