After request hours on Thursday, Intel( INTC) released earnings for the alternate quarter. Profit grew, but earnings per share fell due to impairment charges. Besides the fiscal results, Intel also revealed farther job cuts along the lines of a 15 reduction, awaiting to employ roughly 75,000 workers by the end of the time.

For the third quarter, Intel gave a profit companion range of$ 12.6 billion to$ 13.6 billion. Wall Street had been awaiting$ 12.6 billion.

Following the report, Intel’s shares originally rose further than 2, but the earnings snappily faded and turned negative.

Over the once 12 months, Intel’s stock has dropped by 28, although it has seen a 13 increase so far this time. As of Thursday, Intel’s request capitalization stood at$ 98 billion. In comparison, rival AMD( AMD) has reached a request cap of$ 262 billion. Meanwhile, AI leader Nvidia( NVDA) has surpassed both, with a request cap of over$ 4 trillion.

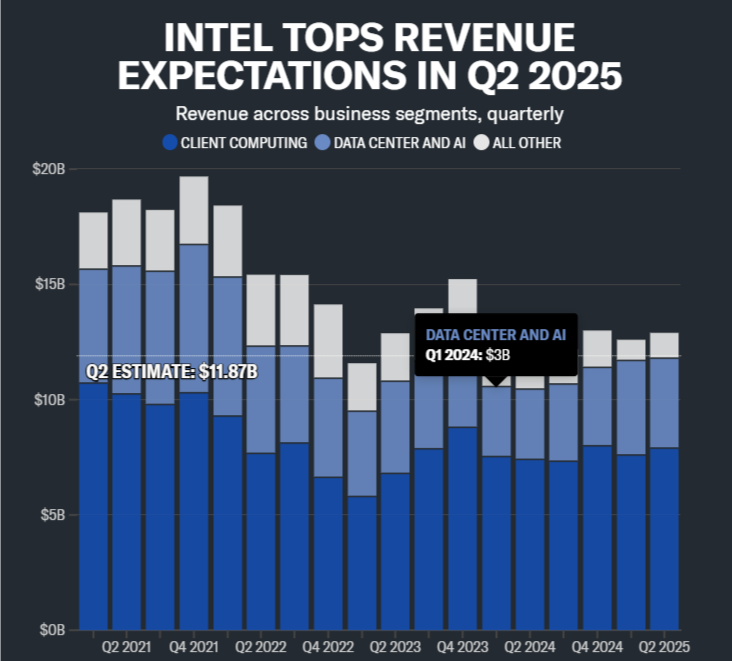

In Q2, Intel posted an acclimated loss of$ 0.10 per share on$ 12.8 billion in profit. Judges surveyed by Bloomberg had anticipated an acclimated EPS of$ 0.01 on$ 11.8 billion in profit. During the same period last time, Intel had reported an acclimated EPS of$ 0.02 on identical profit of$ 12.8 billion.

>>Read More: Tesla Q2 Profit Falls 16% Amid EV Sales Drop, Policy Changes, and Market Pressure

Intel said it incurred anon-cash impairment and accelerated deprecation charge of$ 800 million related to “ preliminarily unidentified applicable outfit, ” along with a one- time expenditure of around$ 200 million. The company also cancelled planned systems in Germany and Poland and is decelerating down construction of its Ohio factory.

Intel’s product business — which includes deals of its laptop and desktop CPUs, data center chips, and AI processors generated$ 11.8 billion in profit, beating prospects of$ 10.9 billion.

In any case, Intel continues to meet considerable competition from AMD and growing pressure from Qualcomm, which continues to make advances into the PC chip arena with Snapdragon X Plus and X Elite processors.

The profit of$ 4.4 billion for Intel’s still expiring foundry business was just a bit above the estimate of$ 4.3 billion, being a bitty 2 growth. This division, aimed at producing chips for third- party guests using Intel’s own processor technology, is still floundering to make significant advance.

preliminarily, Intel had blazoned agreements to produce chips for Microsoft and Amazon using its advanced 18A process technology — a crucial action backed by former CEO Pat Gelsinger to bolster the company’s manufacturing division.

Although earlier reports had cast mistrustfulness on whether Intel would continue offering the 18A process to third- party guests, CEO Pat Gelsinger’s successor,( presumably CEO Tan( if this refers to new leadership)), clarified that Intel plans to first gauge the technology for its own internal chips, with the thing of attracting external guests in the future.

[…] to FactSet, the deal gives the fourth-largest shareholder, Softbank, a 2% share of Intel. It’s a strong vote of confidence for Intel, which has so far failed to capitalize on the AI boom […]

Spincassino, got the spins on my mind! Hope they have a good selection of slots. Let’s give it a whirl! spincassino

xjusdigvzikxswutmtejgedsqfnuso

lswhevqzkfufwrryqjtdqudzwkukdp

poetdzihystntrnzlyorwxrixeqlno

sfdsyeiugijynurkiqufjwfqyllzpm

tqkklrhfwfdpoqiywguoqsokrfxwpu